Buying a used yacht based solely on its appearance, the seller's sales pitch, or a quick online price check? The money you save on appraisal fees might end up costing you several times more later—plus a whole lot of frustration! This is what a captain friend of mine once told me. Now it's 2025, and if you're thinking about buying a used yacht for fun, don't rush! Regarding the matter of “valuation,” drawing from my friend's experience of falling into a pitfall, I need to discuss with you why yacht valuation is the key to a successful transaction, along with five essential things you must grasp—including the three core data points you absolutely need to master.

Article Topics

First, let me share my friend's cautionary tale

Why is yacht valuation crucial to a successful transaction?

Dispelling the Myth: Yacht Valuation Is Far More Complex Than You Think

a.The Misconception of “Pricing Based Solely on Size/Brand”

b.Hidden Value Dimensions Drive Pricing

The 3 Essential Data Types You Must Master

a.Vessel Documentation

b.Equipment Inventory

c.Maintenance History

Market Factors Impacting Prices in 2025

Comparing Professional Valuation Methods

a.Third-Party Institution Assessment

b.Dealer Quotes

c.Online Tools

First, let me share my friend's cautionary tale

This happened two years ago when my friend really wanted tobuy a used Azimut yacht that looked absolutely gleaming, drawing all eyes at the marina. As my friend described it: "The seller was this super friendly old skipper who patted his chest and swore the boat was in great shape—just serviced, and the price was a steal! His asking price was way below what I'd found online for similar models. I was thrilled, feeling like I'd scored a huge bargain!"

I tried to convince him to get a professional inspection and valuation, but he dismissed it. “Can't I just look it up online?” he argued. “Besides, the boat looks brand new, and the old captain seems trustworthy. What could possibly be wrong?” Why waste money on appraisals and inspections? So he bought the used boat.

The first few weeks were pure bliss—cruising the ocean felt like life's pinnacle. But joy was short-lived. One day far from the dock, the engine suddenly emitted a “clunk-clunk” sound like it was falling apart, then died completely! He spent a fortune towing it back for inspection. The repairman shook his head as he examined it: the gearbox was nearly worn to shreds, the stern shaft seal was long gone, and worst of all, the records revealed the boat had been severely beached and repaired before! The seller never mentioned any of this!

In the end, fixing these issues alone wiped out my entire six-month vacation budget—and left me feeling utterly gutted. That was a costly lesson indeed! If you're buying a used yacht for the first time, familiarize yourself with these 7 common pitfalls beforehand.

Why is yacht valuation crucial to a successful transaction?

In pre-owned yacht transactions, an accurate appraisal report isn't just a formality—it's the core risk control mechanism determining the deal's success. Why? Two reasons:

First, for buyers, it serves as bulletproof protection against brand premium bubbles and hidden damage. Second, for sellers, it's the sole benchmark ensuring fair asset valuation and preventing undervalued sales.

Of course, as a buyer, we won't dwell on the seller's tactics. During the purchase process, if you overlook professional valuation like my friend did, you risk falling into a double trap. Debt could spiral out of control—simply put, you might pay an inflated premium for a halo brand, saddling yourself with loans far exceeding the yacht's residual value. More critically, hidden damage requiring repairs could trigger catastrophic expenses!

I once encountered this statistic in Huayuan Securities' Used Yacht Liquidity Report: Clarkson Securities data reveals that underestimating the value of equipment upgrades (such as stabilizers and environmental systems) causes sellers to lose an average premium of 120,000 to 300,000 yuan. This underscores the critical importance of yacht valuation during the purchasing process. As the Society of American Appraisers (SAA) warns: “Skipping the appraisal fee in a yacht transaction is essentially buying a ticket to litigation.” What do you think?

Dispelling the Myth: Yacht Valuation Is Far More Complex Than You Think

The Misconception of “Pricing Based Solely on Size/Brand”

The seemingly logical assumption that “same size and brand = same price” is actually the most costly cognitive trap for pre-owned yacht buyers! Clarkson Securities revealed that two 50-foot powerboats of the same year and model can have price differences of up to 30%-40% due to hidden condition variations.

For instance, a Fairline Targa 50 with regular factory maintenance and no accident history might list for ¥3.2 million. Yet another “same model” yacht—concealing prior grounding repairs and engine overload issues—sold for just ¥2.2 million, evaporating a million-yuan price difference.

Hidden Value Dimensions Drive Pricing

When valuing a yacht, never overlook these four hidden value dimensions: hull condition, maintenance history, upgrades/modifications, and equipment completeness.

First, hull condition: A hidden structural flaw, minor deck leaks, or metal fatigue in superstructure components can cause a yacht's value to plummet dramatically. Undisclosed structural repairs—like collision reinforcements or keel straightening after groundings—typically reduce prices by 28%-35%!

Maintenance records act as mechanical timebombs: engines exceeding safe operating hours or skipped critical maintenance can trigger massive repair bills at any moment. Maintenance logs reveal whether the yacht has been serviced with clockwork precision, the operating hours of critical equipment (engines, generators, steering systems), and any major overhaul history.

Did the previous owner upgrade or modify the yacht? Examples include installing new navigation systems, zero-speed stabilizers, or eco-friendly water treatment systems. If so, these systems command premium value. For instance, zero-speed stabilizers retain 85% of their original value, while eco-friendly water systems retain 70%.

Regarding equipment completeness: Simply put, will the tender, water toys, and high-end audiovisual systems transfer with the yacht? These all factor into its valuation.

The 3 Essential Data Types You Must Master

The following section may be a bit dry, but vessel documentation, equipment lists, and maintenance history are absolutely critical when purchasing a pre-owned yacht. Together, they assess a yacht's true value and technical condition while revealing potential risks. Let me explain each in detail.

Vessel Documentation

Just as every person needs an ID card at birth, so does a yacht. The year of manufacture, precise model, and serial number serve as the yacht's identification. These allow you to verify original specifications, service bulletins, or trace its history with the manufacturer.

The original equipment list and detailed records/certificates of all major modifications and upgrades clearly document all factory-installed equipment, materials, and specifications. Crucially, they must include complete records of all subsequent major modifications, equipment upgrades, or structural alterations. This encompasses—but is not limited to—engine replacements, generator upgrades, stabilizer installations, navigation system replacements, hull structural modifications, etc. Before finalizing the purchase, ensure the owner provides these records!

The most crucial step is obtaining ownership history documents, such as sales contracts and copies of registration certificates. These reveal whether the yacht has changed hands frequently. Multiple ownership transfers within a short period should raise red flags! This could signal potential issues—undisclosed problems, poor maintenance, or ownership disputes. If these uncertainties exist, I strongly advise against proceeding with the purchase.

Equipment Inventory

If vessel documentation is the yacht's ID, then the equipment inventory is its tangible asset list. This checklist must comprehensively detail all major installed equipment and systems, along with their current condition. When considering a pre-owned yacht, insist on a clear inventory and verify items on-site whenever possible.

Below is a sample checklist template for your reference:

| category | Device Name | Key record items | Status/Remarks Request |

| Core power system | main engine | Brand, exact model, power rating (HP/kW), year of manufacture, operating hours | Provide complete maintenance logs, overhaul records (time, content, and execution party), and replacement vouchers; check whether the hour meter can be verified to be tamper-free. |

| dynamo | Brand, model, power (kW), year of manufacture, operating hours | Maintenance records, overhaul/replacement certificates; generator hours are typically required to be significantly lower than main engines. | |

| Navigation and navigation systems | radar | Brand, model, antenna size, whether it supports ARPA, and year of installation | Current functional status, latest calibration date; whether the scanning effect is clear and stable. |

| GPS/Chartplotter | Brand, model, screen size, chart vendor (e.g., C-MAP, Navionics), software version | System response speed, touch screen sensitivity, chart update validity period; whether AIS/radar is integrated. | |

| Autopilot | Brand, model, compatibility with servos, year of installation | Route following accuracy, whether the servo response is abnormal; the last calibration record. | |

| AIS | Model (Class A/B), MMSI code, installation year | Whether the signal transmission/reception is normal; integration status with the chartplotter. | |

| Depth Sounder/Sonar | Brand, model, features (such as bottom tracking, fish finding) | Accuracy of water depth data and clarity of seabed topography imaging. | |

| VHF radio | Brand, model, whether it has DSC function, installation location | Call quality, DSC test records; spare handheld VHF configuration. | |

| Value-added configuration | Stabilizing fins/gyroscopes | Type (hydraulic fins/gyros), brand (e.g., Seakeeper, Naiad), model, year of installation, operating hours | Maintenance records, current anti-roll effect; whether the hydraulic system is leaking; gyroscope start-up time and noise. |

| Hydraulic swim platform | Brand, model, load capacity, dimensions, year of installation | Check whether the sealing of the hydraulic cylinder and the lifting speed are normal; whether the deck plate is corroded or deformed. | |

| Seawater desalination machine | Brand (e.g., Sea Recovery), model, water production (gallons/day), year of installation | Maintenance records, membrane module replacement time, effluent water quality report (TDS value); frequency of use and fault history. | |

| Entertainment system | Audio systems (brand/speaker layout), TVs (number/size/brand), satellite TV (e.g., KVH TracVision), streaming devices | Whether the device linkage is normal; the validity period of the satellite subscription; the heat dissipation condition of the audio amplifier. | |

| Tender boats and davits | Tender: Material (RIB/Fiberglass), Size, Engine Brand/Power/Hours Davit: Type (Hydraulic/Electric), Brand, Load Capacity | Whether the hull of the auxiliary boat has been repaired and the engine start-up status; the wear degree of the boom wire rope and the pressure value of the hydraulic system; the lifting test video or operation record. |

Maintenance History

Want to see what's really going on inside a pre-owned yacht? Maintenance records are the “golden key”—far more reliable than just looking at the exterior! A clear, chronologically organized record backed by invoices and work orders is the best proof of whether the owner truly cherished the vessel.

It reveals engine wear levels, hidden defects, the severity of past accidents, and future repair costs. If records are vague, incomplete, or missing entirely—that’s a major red flag signaling significant potential risks! As the 2025 Used Yacht Insurance Guide reveals, even with insurance coverage, premiums surge dramatically the year after a claim.

What should you focus on during verification? Keep a close eye on these three areas:

Evidence of timely maintenance: Basic operations like engine oil/filter changes, gear oil replacements, and hull antifouling applications—were they performed on schedule?

Accident history: Were collisions, scrapes, groundings, or water ingress (even minor) honestly disclosed? Verbal claims aren't enough—demand documentation like incident reports, crucially including insurance-approved claims settlements and official repair invoices/photos from reputable shipyards. These prove the incident's severity and whether repairs were properly executed.

Major overhaul records: Detailed maintenance reports, replacement parts lists, and purchase receipts for new machinery are required for any major engine or generator overhauls/replacements, hull/deck crack repairs/leak fixes, or major upgrades/overhauls to navigation systems, stabilizers, air conditioning, or hydraulics.

Market Factors Impacting Prices in 2025

Having covered factors specific to the yacht itself, let's briefly discuss additional influences on used yacht prices in 2025. To secure your dream vessel at the most favorable price, understand these three points: regional supply-demand dynamics, seasonal fluctuations, and emerging yacht models.

Regional Supply-Demand Disparities: In popular vacation destinations like the Mediterranean and Caribbean, used yacht prices may continue to rise or remain relatively resilient. Why? Overwhelming demand! Everyone wants a boat in their dream waters. Those who can't afford new ones or face long wait times rush to buy used. Owners aren't in a rush to sell, so prices stay firm. But in parts of Southeast Asia, the new boat market is booming! Manufacturer promotions, increased local production capacity, or changes in import taxes make new boats more attractive. This forces used boats to drop prices to compete for buyers—why would anyone choose an older model? Consequently, used boat prices face significant pressure in these regions.

Seasonal Fluctuations: This mirrors yacht charter patterns. Take Dubai: spring and winter see peak charter demand. Booking your preferred yacht in summer often requires one to two months' advance notice! Yet during summer, relentless heat slows charter business significantly. The yacht sales market follows suit.

Emerging Boat Types: According to Fortune Business Insights, yacht manufacturers are ramping up electric yacht production. Porsche collaborated with Frauscher to develop the Frauscher X Porsche 850 Fantom Air, powered by a 100 kWh lithium-ion battery. This means that by 2025, electric yachts, hybrid yachts, and smart vessels with AI-assisted (or even autonomous) navigation will undoubtedly become more prevalent, mature, and eye-catching. This poses a significant challenge to the used market, especially for traditional pure-fuel-powered boats and older models with outdated electronics! Which would you choose?

Comparing Professional Valuation Methods

When exploring the pre-owned yacht market, obtaining an accurate and reliable valuation is essential—but do you know how to get one? Drawing on industry expertise and years of market observation, I present three methods below for comparison!

Third-Party Institution Assessment

Conducted by Marine Surveyors holding internationally or nationally recognized qualifications, such as SAMS. You can filter for professional surveyors by U.S. state, Canadian province, or other countries/regions.

The surveyor conducts an on-site, systematic, and impartial inspection and assessment of the hull structure, mechanical equipment (engine, generator), electrical systems, navigation equipment, safety devices, etc., adhering to strict industry standards. The final deliverable is a detailed, structured, legally admissible written report. This includes an assessment of current market value, a technical condition rating, a list of all identified defects, necessary repair recommendations, and estimated costs.

Dealer Quotes

Dealers operate at the forefront of the transaction market, possessing real-time insights into supply-demand dynamics, brand popularity, and regional price variations. If you're in the initial screening phase and wish to understand the approximate market value range for your target yacht model, consulting a dealer is a more convenient approach. However, note that this cannot replace an independent assessment of the yacht's specific condition!

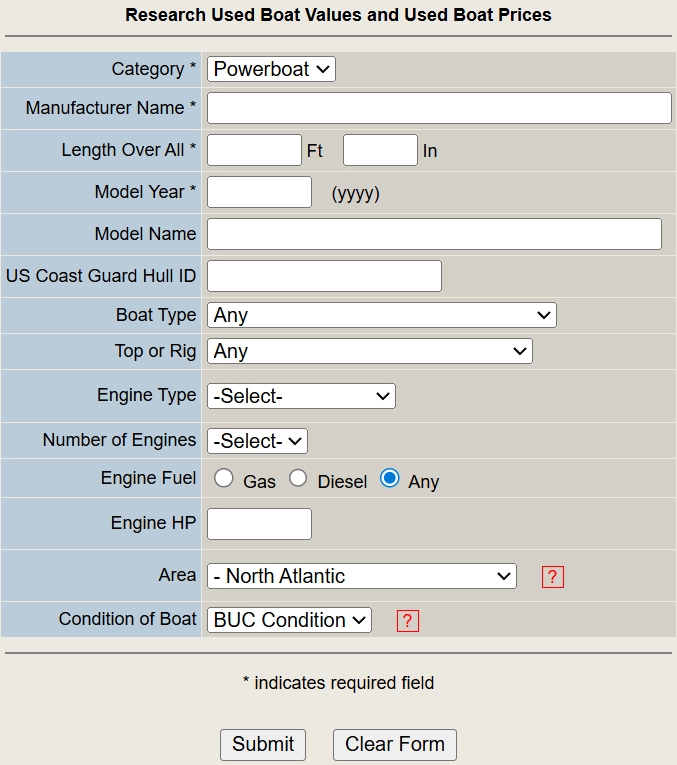

Online Tools

Many major yacht trading platforms utilize historical transaction databases to build algorithmic models. By inputting basic yacht parameters, you can obtain an estimated value range. Here, I recommend a tool I frequently use: BUCValu.

Conclusion

A precise valuation report is your most effective tool for avoiding exorbitant repair traps and ensuring a fair transaction. In the 2025 pre-owned yacht market—filled with both opportunities and challenges—the allure of purchasing a used yacht is strong. Yet, diving in without professional valuation is akin to gambling. My friend's painful lesson serves as a stark warning: saving a few thousand yuan on appraisal fees could ultimately cost you hundreds of thousands in repairs—or even shatter your boating dreams entirely! Having covered these five key points on yacht valuation, I hope you now have a clearer understanding of purchasing pre-owned yachts.

Riley Miller

Riley Miller is the owner of the “Serendipity” yacht, a contributing columnist for “Yachting Monthly,” and has published 17 in-depth analyses on yacht cost management. He also serves as an advisory committee member for the European Second-Hand Yacht Association (ESYA) and holds the International Yachting Certificate ICC-UK-2019C-17429, with certified cruising areas covering the Mediterranean and the western coast of the Atlantic.

Disclaimer

1. The information provided herein (including but not limited to market trend analysis, pricing examples, professional advice, and third-party tool recommendations) is for general reference and educational purposes only. It does not constitute any form of professional appraisal, financial advice, or purchase commitment.

2. Specific data, reports, and institutional viewpoints cited in this document are based on publicly available information and the author's experience. Their accuracy and timeliness may be subject to adjustment due to market dynamics. Readers are advised to independently verify the latest information.

3. Pre-owned yacht transactions involve complex technical evaluations and legal risks. Individual cases possess unique characteristics and cannot be directly applied. Actual vessel values are influenced by unmentioned factors such as hidden damage, regional regulations, and exchange rate fluctuations. The premium or discount ratios mentioned herein are illustrative only.

4. Readers assume full responsibility for any decisions or subsequent actions taken based on this information. We strongly recommend: Prior to any transaction, engage an independent surveyor holding SAMS (Society of American Marine Surveyors) or equivalent international certification for an on-site inspection, and consult maritime lawyers, tax advisors, and other professionals. This platform and the author shall not be liable for any direct or indirect losses arising from reliance on the content herein.