Stay Updated with Agro Cultures News

Interdum nullam est, aliquam consequat, neque sit ipsum mi dapibus quis taciti. Ullamcorper justo, elementum pellentesque gravida quisque.

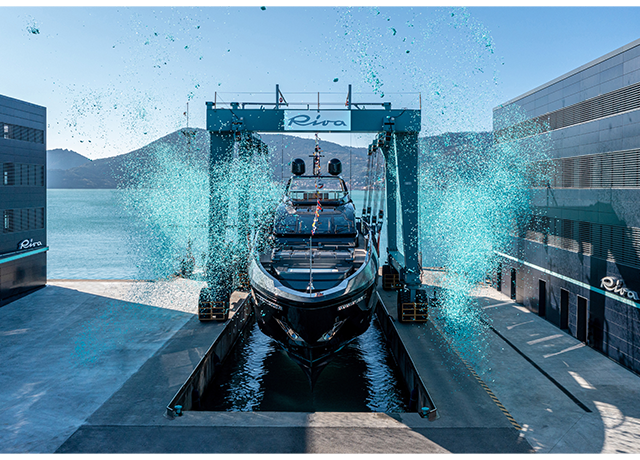

A $240,000 price gap between two nearly identical boats taught me everything I need to know about Riva pricing. Last month, I was comparing a 2019 56 Rivale in Palma with another in Fort Lauderdale—same hours, similar specifications, yet the Florida listing commanded a substantial premium. The reason? A recent electronics refresh, crisper interior detailing, and timing: the Palma boat appeared just as charter season wound down, when Med inventory peaks and buyers negotiate harder. That single comparison captures the Riva story: the brand creates the foundation, but year, condition, upgrades, and location determine the final number.

Riva’s premium isn’t accidental—it’s engineered through the Ferretti Group’s rigorous standards for joinery, paintwork, and exterior sculpture, consistently maintained across the entire range. Brokers I trust often reference “Riva uplift” as shorthand: when condition is comparable, Riva’s elegant design in exterior and interior styling serves as the luxury yacht builder’s hallmark, typically pushing asking prices 8–15% above similar Italian sport yachts.

Three factors drive this consistently:

Design continuity: From the legendary Aquarama heritage to today’s Dolceriva and 88 Folgore lines, the Riva range expresses the soul of this legendary brand to sublime effect. The silhouette and detailing age gracefully and resell confidently.

Finish and materials: Genuine veneers, tight tolerances, superior sound attenuation. Cabin doors close with a soft, confident weight you notice instantly—it’s craftsmanship you feel in your hands.

Fleet visibility: Riva’s presence in Cannes, Monaco, Miami, and Hong Kong creates cross-regional demand. When a buyer in Asia knows they can exit cleanly into the Med or U.S. market within two years, prices remain firm.

That halo doesn’t override fundamentals, though. A Riva with high hours, outdated navigation gear, or shaft-angle vibration issues will price down—just more gently than market average.

Below are real-world bands I’ve observed hold over the past 12 months. They shift seasonally and with inventory, but they provide a reliable compass. Regional notes compare the Med, U.S., and Asia where differences appear.

Think Iseo, Aquariva, Rivamare, Dolceriva, Rivale.

Regional pattern: The Med usually shows more selection and sharper negotiation mid-winter. U.S. asking prices are often firmer but include fresher electronics and upholstery. Asia can carry a scarcity premium, especially for Rimamare and Dolceriva.

Think 66 Ribelle (sportfly), 76 Perseo Super (sportfly), 82 Diva, 90 Argo.

Why these spreads? Stabilizer fitment (gyro vs. fins), generator count, and the AV/IT backbone (Crestron/Control4 vs. simpler setups) materially affect day-to-day comfort—and resale.

Think 100′ Corsaro, 110′ Dolcevita, 130′ Bellissima.

At this scale, class compliance, toy garages, shore-power configurations, and crew-area execution all influence liquidity—and hence price.

Classic wooden Rivas (Aquarama, Ariston) and modern composite Rivas live in different maintenance universes.

Classics: Purchase prices typically range $500k–$1.5M, with concours-restored Aquaramas reaching beyond $2M. Annual care is craftsmanship-heavy: $35k–$80k is common for storage, varnish cycles, and specialist labor. Insurance can be quirky—some carriers require specific yards and freshwater storage.

Modern composite/alloy models: Annual running costs usually sit around 7–10% of the yacht’s value. For a 48–66′ Riva, expect $60k–$180k including dockage, insurance, routine service, and cosmetics. On 100’+, budget mid-six figures; major yard periods can push higher.

Upgrades that move the needle: Seakeeper or fin stabilizers ($80k–$250k installed, size-dependent), electronics refresh ($25k–$90k), and exterior paint or teak replacement (variable, but five-figure to low six-figure). These improve both enjoyment and resale if documented well. For detailed maintenance specifications on common Riva powerplants, MAN’s marine diesel engine service documentation provides comprehensive technical guidance.

If “investment” means total return, yachts rarely qualify. But if we define it as value retention and liquidity, Riva performs better than most peers.

Depreciation: A rule of thumb is to expect 10% depreciation in year one and 6-8% for the following four or five years. Riva’s brand tends to compress that curve by a couple of points versus the broader sport-yacht market. Premium brands like those in Riva’s class, known for superior engineering and yacht design,generally show more resilience to market dips. Well-kept Rivamares and 56 Rivales are standout holders.

True price drivers, in order: year, engine hours (bands at 300–700–1,200 matter), stabilizers, electronics currency, and interior freshness. Region affects time-on-market more than intrinsic value. Buy the cleaner hull with the clearer paper trail—the market rewards that discipline at resale.

Understanding broader yacht depreciation patterns and resale value factors can help contextualize how Riva’s premium positioning affects long-term value retention.

The difference between a smart Riva purchase and an expensive lesson often comes down to knowing which details matter. If you’re weighing a specific listing, I’m happy to sanity-check the asking figure, compare regional comps, or outline a pre-offer inspection plan. Send the listing link, hour count, option list, and your intended home port—I’ll map the asking price against recent transactions, factor in upgrade value, and suggest a negotiation range that respects both the boat’s quality and your budget.

Here’s what I’ve learned after years of tracking these boats: choose the best-kept example you can comfortably support, not the cheapest on the page. With Riva, condition is the multiplier that makes both the numbers and the ownership experience work. The brand’s official model range showcases current specifications, but the real value story is written in service records, material choices, and how previous stewardship shows in the details—from engine room presentation to the way locker doors align. That’s where the $240,000 gaps appear, and where smart buyers find their edge.