Stay Updated with Agro Cultures News

Interdum nullam est, aliquam consequat, neque sit ipsum mi dapibus quis taciti. Ullamcorper justo, elementum pellentesque gravida quisque.

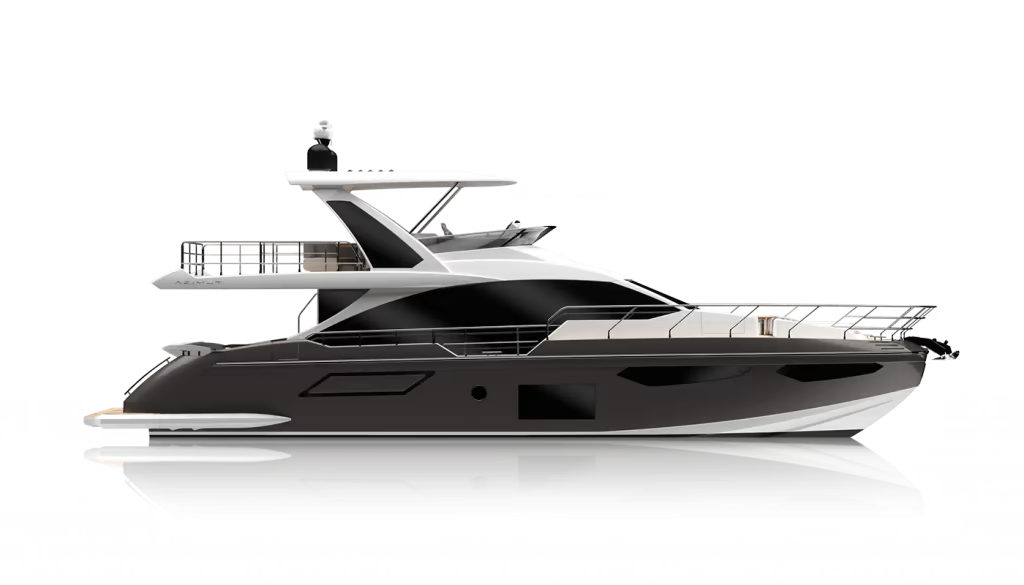

Last month I was tracking Azimut 60 listings across major markets when I noticed something striking: a 2012 model listed at $1.1 million, while a 2024 build sat at $3 million. Same yacht platform, wildly different price tags. The gap came down to year, condition, equipment, and location.

But here’s what most buyers miss: the purchase price is just your entry ticket. Annual ownership costs—docking, fuel, crew, insurance, maintenance—typically add another $150,000 to $250,000 per year depending on how you use the yacht. If you’re serious about an Azimut 60, you need the full cost picture before signing.

The Azimut 60 market spans $1.1M to $3.0M USD depending on model year, condition, and location. Understanding where each price bracket sits helps you identify value versus overpaying.

Price Range: $2.4M – $3.0M USD

When you order a new Azimut 60 Flybridge directly from the factory, you’re paying for full warranty coverage, custom layout selections, zero engine hours, and the latest navigation systems. Delivery typically takes 8-12 months from order to handover.

The flybridge configuration adds approximately $100K-$150K to the base price but delivers extra square footage, duplicate helm controls, and sun pads. The trade-off? You’ll absorb roughly 15% depreciation in year one alone. Explore new models at authorized dealers like MarineMax.

Price Range: $1.6M – $2.0M USD

This is the market sweet spot and gets the most buyer interest for good reason. These models are already past the steepest depreciation curve while retaining modern navigation, entertainment systems, and typically showing under 400 engine hours. You get immediate availability instead of waiting 8-12 months for a new build. View current Azimut 60 review for details.

Four-cabin layouts in this range command 5-8% higher resale values compared to three-cabin versions because they appeal to both charter operators and larger families. Custom interior finishes like high-gloss wood or upgraded marble may have added $80K-$200K to the original build cost, but typically recover only 40-60% of that investment on resale.

Price Range: $1.3M – $1.6M USD

This bracket represents the sweet spot for value-conscious buyers balancing price with capability. Most yachts in this range show 400-800 engine hours and may need minor electronics updates—think chartplotters, radar systems, or entertainment upgrades—but remain mechanically sound if properly maintained.

Buyers should budget an additional $15K-$30K for electronics modernization if the yacht hasn’t been recently updated. Complete service records from authorized Azimut dealers significantly impact value within this range.

Price Range: $1.1M – $1.3M USD

Entry-level pricing for the Azimut 60 platform. These yachts typically show higher engine hours (800+ hours), and buyers should anticipate potential refit costs for interior soft goods and exterior teak work. However, they remain mechanically sound if well-maintained with documented service history.

Critical evaluation factors include complete service records, hull survey results checking for osmosis and structural integrity, and the condition of major systems like generators, thrusters, batteries, air conditioning units, and watermakers. Budget $40K-$80K for cosmetic updates if needed.

Purchase price is one-time. These costs repeat every single year and determine whether yacht ownership fits your lifestyle and budget.

Mediterranean (High Season):

Southeast Asia:

North America:

Annual contracts typically save 15-20% compared to transient daily rates. Owners who commit to 10-month terms in popular cruising areas can negotiate significantly lower effective monthly rates.

The Azimut 60 runs twin Volvo Penta D13-900 engines (900 HP each) with a top speed around 30-31 knots.

Fuel Consumption Rates:

Annual Fuel Costs (assuming 100 cruising days):

Regional fuel pricing varies: Europe averages $1.20-$1.50/liter, Asia $0.90-$1.10/liter, and North America $1.00-$1.30/liter. If you cruise 100 days per year at 20 knots (averaging 8 hours per day), you’re burning approximately 160,000-200,000 liters annually.

Professional Captain (Full-Time Employment):

Freelance Captain (Per-Day Rate):

Most Azimut 60 owners in the 40-100 days/year usage range hire captains on a daily or weekly basis rather than maintaining full-time crew, which significantly reduces annual overhead.

Hull Insurance:

Registration Fees:

Annual Maintenance:

Industry best practice: budget 2-3% of yacht value annually as a safety buffer for unexpected repairs like thruster failures, air conditioning replacement, or electronics issues.

Understanding these three factors helps you identify deals, avoid overpriced listings, and negotiate effectively.

Depreciation follows a predictable curve:

Engine hours often matter more than calendar age. A 2015 model with 300 hours frequently commands $100K-$150K more than a 2017 model with 900 hours. The market sweet spot is 2018-2020 models with 250-500 hours, balancing modern systems with reasonable hours and manageable future depreciation.

Mediterranean listings typically run $100K-$200K higher than comparable yachts in Asian markets. This premium exists because of higher European buyer demand, better surveying and sea trial infrastructure, easier EU bank financing options, and established brokerage networks.

Regional demand follows seasonal patterns: Mediterranean sees peak buying March-June for summer season, Caribbean peaks November-January for winter season, while Southeast Asia maintains year-round activity with less seasonal volatility. Transport costs between regions run $40K-$60K, which limits arbitrage opportunities.

Two identical Azimut 60s can differ by $150K+ based purely on maintenance history and condition. Premium pricing indicators include complete service records from authorized Azimut dealers, recent major service completion with documented invoices, low annual usage under 100 hours/year, original ownership with continuous maintenance, and recent upgrades to electronics, generators, or HVAC systems.

Red flags that damage value include missing or incomplete service logs, visible deferred maintenance like staining or worn teak, multiple ownership changes in short periods, undocumented charter history, and non-OEM parts used in major repairs.

Smart buyers understand depreciation patterns before purchasing—it’s often the largest cost of ownership beyond the initial purchase.

Scenario 1: Buying New in 2025

Scenario 2: Buying 2020 Model in 2025

The math clearly favors used purchases: buying a 3-5 year old model typically delivers better total cost of ownership over five years because the steepest depreciation drop (years 1-3) has already occurred.

Optimal buying window: November-February

Off-season timing in the Mediterranean creates motivated sellers. Yacht show season concludes, inventory increases, and sellers face approaching winter storage costs. January listings historically average 8-12% lower than June peak-season prices.

Secondary opportunity exists September-October at the end of Mediterranean summer season when owners realize actual usage fell short of plans and want to avoid winter maintenance expenses.

Optimal selling window: March-May

Buyers planning for upcoming summer season pay premiums during these months. Spring boat shows drive buyer enthusiasm, improving weather enables more sea trials and inspections, and purchase urgency peaks. Spring sales historically average 6% higher prices than fall sales.

Preparation should begin 60-90 days before listing: complete all deferred maintenance, arrange professional detailing, update outdated electronics, organize complete service records, commission professional photography, and consider pre-listing survey to identify issues before buyers discover them.

The Azimut 60 occupies a unique position: large enough for serious cruising but manageable without full-time crew.

Ideal profile: 2-3 couples or families with children, 40-80 days usage annually, weekend getaways plus 2-3 extended trips, primary cruising range 200-500 nautical miles from home port.

The three or four cabin layouts accommodate guests comfortably, the flybridge provides separate entertainment space, and the yacht remains manageable for experienced owner-operators. Hire captains on per-trip basis rather than full-time.

Typical annual costs: $150,000-$180,000 (conservative usage, freelance captain)

Ideal profile: Offset ownership costs with 6-10 charter weeks annually, professional management company handles operations, owner use 40-60 days plus charter use 40-60 days, Mediterranean or Caribbean markets.

Four-cabin layouts appeal to charter clients, strong Azimut brand recognition supports viable weekly charter rates ($18K-$35K/week), but management fees consume 25-35% of gross revenue and charter use increases maintenance costs $20K-$30K annually.

Financial reality: Gross charter income $150K-$250K/year, net offset to ownership costs: $80K-$150K/year

Ideal profile: Extended cruising 3-6 months per year, seasonal migration between regions, experienced boaters comfortable with passage-making, value range and fuel efficiency at displacement speeds.

The Azimut 60 offers 800+ nautical mile range at economical speeds, stabilizers for open water comfort, and equipment redundancy for offshore reliability. However, transport costs between Asia and Mediterranean run $40K-$60K, and maintaining dual home ports creates dual registration and insurance expenses.

Typical annual costs: $200,000-$250,000 (includes transport, dual locations, higher fuel use)

For more insights on long-range Azimut cruising capabilities, the Azimut 60 offers 800+ nautical mile range at economical speeds.

How much does an Azimut 60 cost? The Azimut 60 ranges from $1.1M to $3.0M USD depending on year and condition. New 2024-2025 models cost $2.4M-$3.0M, while used models from 2019-2022 range $1.6M-$2.0M. Older models from 2012-2014 start around $1.1M-$1.3M.

What are the annual costs of owning an Azimut 60? Annual ownership costs typically range $150,000-$250,000 including docking ($25K-$90K depending on region), fuel ($35K-$85K), insurance ($18K-$27K), maintenance ($25K-$40K routine), and crew costs if applicable ($20K-$85K).

How much does an Azimut 60 depreciate? New Azimut 60s depreciate 12-18% annually in years 1-3, then 6-10% in years 4-8, flattening to 3-5% after year 9. A $2.5M new yacht loses approximately $700K-$900K over five years, while a used purchase depreciates $400K-$500K over the same period.

Should I buy a new or used Azimut 60? Used Azimut 60s from 2019-2022 ($1.6M-$2.0M) offer the best value, having already absorbed the steepest depreciation while retaining modern systems. Calculate total 5-year ownership cost including depreciation to determine best value for your situation.

When is the best time to buy an Azimut 60? November-February offers the best buying opportunities, with January listings averaging 8-12% lower than June prices. Off-season timing, increased post-boat-show inventory, and seller urgency before winter storage create optimal negotiation conditions.

What maintenance costs should I budget for an Azimuxt 60? Budget $25,000-$40,000 annually for routine maintenance (engine service, bottom paint, systems checks) plus $60,000-$100,000 every 3-5 years for major service (engine overhauls, teak replacement). Set aside 2-3% of yacht value annually for unexpected repairs.

The Azimut 60 sits in the sweet spot: large enough for serious cruising but manageable without full-time crew. In 2025, budget $1.1M-$3.0M for purchase depending on age and condition, plus $150K-$250K annually for operation.

The smartest buyers run total cost numbers first (purchase plus 5 years ownership), factor in realistic annual usage, time purchases when market conditions favor buyers (November-February), focus on 2019-2022 models with under 500 hours, and verify complete service records before making offers.